Why September’s Defying History (And Why You Should Care)

Here’s something remarkable: September is traditionally Bitcoin’s worst month. But not this year.

While the calendar might suggest caution, the crypto market is showing jaw-dropping strength as we enter what’s historically been a weak period.

Despite these seasonal headwinds, the total cryptocurrency market capitalization has crossed the $4 trillion mark, reaching $4.01 trillion as of September 15.

Here’s what you need to know right now:

- Trading volume stands at a healthy $155 billion

- 95 of the top 100 coins are green over the past 24 hours

- Bitcoin has gained over 6.79% month-to-date – defying historical patterns

This isn’t just another market blip.

This is a fundamental shift where macroeconomic forces are overriding seasonal trends.

If you’re not paying attention to the latest web3 news, you’re missing the most significant market transformation since the 2021 bull run.

The Two Events That Will Make or Break Your Portfolio

Let’s cut through the noise. Everything in crypto right now revolves around two critical events:

- September 17: Federal Reserve interest rate decision (95% probability of at least 25 basis points cut)

- September 11: US Consumer Price Index (CPI) data release

Here’s what most analysts aren’t telling you: Markets have likely already priced in the expected rate cuts.

This means the actual decision could trigger violent volatility, not the smooth ride many expect.

The hidden truth: A surprise 50 basis point cut would likely accelerate the move toward $160,000 Bitcoin targets, while a more modest 25 basis point cut could actually disappoint the market.

https://coinmarketcap.com/historical/20250914/

For the latest crypto news today, this Fed decision represents the most critical catalyst for the remainder of Q3 and your portfolio’s performance.

How Will Bitcoin’s Golden Cross Impact Market Trends?

The Technical Pattern That Changes Everything

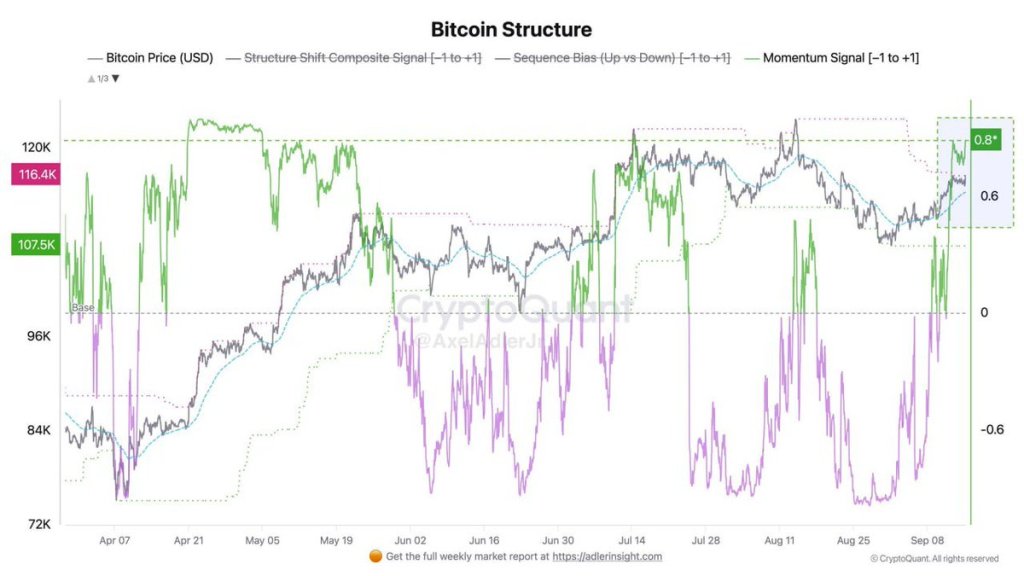

As of Monday, September 15, Bitcoin is trading at $114,817, consolidating around the crucial $115,000-$116,000 range. The cryptocurrency tested highs of $116,757 early in the session before settling slightly lower.

But here’s what really matters: The formation of a MACD golden cross pattern on September 5, the first such bullish signal since April 2025.

“The last time such a golden cross occurred was in April,” when Bitcoin subsequently reached new all-time highs above $124,000. – Popular trader BitBull Read the full technical analysis here

This isn’t just another chart pattern. It’s a rare signal that has preceded 40% rallies in the past.

For the latest bitcoin and crypto news from major outlets, this technical pattern suggests we’re witnessing the early stages of a significant upward move that could dwarf previous rallies.

Which Bitcoin Levels Should Investors Monitor Closely?

Don’t get caught on the wrong side of the market. Here’s exactly what to watch:

| Technical Level | Price Range | What It Means For You |

|---|---|---|

| Immediate Resistance | $116,000-$117,000 | Break here = immediate 5% upside opportunity |

| Key Resistance | $120,000 | Gateway to new all-time highs—set profit targets here |

| Current Support | $114,500-$115,000 | Weekly close above = keep buying the dips |

| Critical Support | $112,000-$113,000 | Break here = pause your accumulation strategy |

| Bear Market Signal | $100,000 | Only worry if we close below this level |

According to analyst Rekt Capital, “the goal is for Bitcoin to reclaim $114k into support first, because that’s what would enable the premium-buying necessary to get price above $117k later on.”

Pro tip: Set alerts at these key levels. When price approaches them, check the latest web3 news for market-moving developments before making your move.

What Are Wall Street’s Bitcoin Price Predictions?

Major financial institutions are increasingly bullish on Bitcoin’s prospects but there’s a hidden divergence in their thinking:

| Institution/Analyst | 2025 Price Target | The Real Story |

|---|---|---|

| Standard Chartered | $200,000 | Betting on institutional adoption wave |

| VanEck | $180,000 | Focused on ETF-driven demand |

| Compass Point | $160,000 | Technical analysis shows this is the minimum |

| Barclays | $116,000 | The outlier—still too conservative |

VanEck’s long-term projections are particularly ambitious, anticipating Bitcoin climbing to $2 million by 2050. For the latest crypto news predictions from Wall Street analysts, this represents one of the most bullish consensus views in Bitcoin’s history—but it’s not just hype.

The untold story: These institutions aren’t just making predictions—they’re allocating billions. Their price targets reflect actual capital deployment plans, not just theoretical analysis.

⚡ ALTCOIN PERFORMANCE: SOLANA LEADS THE CHARGE

How Solana is Eating Ethereum’s Lunch

While Bitcoin dominates headlines, Solana is quietly revolutionizing the blockchain landscape. The network has demonstrated impressive growth across multiple metrics:

- DEX Volume: Solana’s decentralized exchanges processed $54 billion in trading volume in July, exceeding Ethereum’s $52 billion—marking the first time Solana’s DEX activity eclipsed Ethereum’s on a monthly basis Full analysis here

- Total Value Locked (TVL): Surged to $12.2 billion as of September 9-10, 2025 – a remarkable 165% increase from $4.63 billion in September 2024

- NFT Market: Hosts over 2.2 million buyers and 1.6 million sellers who have completed nearly 43 million transactions

This isn’t just growth, it’s a fundamental shift in market dynamics.

For the latest solana crypto news, this performance has positioned Solana as a serious contender to Ethereum’s dominance, and the institutional money is following.

The Real Reason Solana Is Winning

Solana’s success isn’t accidental. It’s built on three core advantages that directly address Ethereum’s pain points:

- Speed: Thousands of transactions per second (vs Ethereum’s 15-30)

- Cost: Transactions often less than $0.01 (vs Ethereum’s sometimes $50+)

- Finality: Near-instant transaction confirmation (vs Ethereum’s 6+ minutes)

This trifecta creates an ideal environment for high-frequency trading, algorithmic activity, and critically user adoption. When your grandma can send crypto without worrying about $50 gas fees, you’ve hit mainstream potential.

The Altcoin That Just Exploded (And Why)

Eightco Holdings (Nasdaq: OCTO) surged over 3,000% after announcing a $250 million plan to adopt Worldcoin as its primary treasury asset. This wasn’t just another pump, it was a strategic pivot by a publicly traded company toward Web3.

For the latest web3 news past 24 hours, this represents one of the most dramatic single-day moves by a publicly traded company embracing crypto.

But here’s what most missed: Eightco’s CEO explicitly stated they’re “building the Web3 infrastructure of tomorrow,” signaling this isn’t just a speculative play but a strategic repositioning.

🏦 INSTITUTIONAL ADOPTION ACCELERATES

The ETF Shift You Need to Watch

US Bitcoin spot ETFs recorded $368.25 million in inflows on September 9, with ten of twelve ETFs seeing positive flows. Fidelity led with $156.5 million, followed by Ark&21Shares’ $89.47 million.

But here’s the hidden story:

- US Ethereum ETFs saw $96.69 million in outflows,

- BlackRock bleeding out $192.7 million despite Fidelity’s $75.15 million inflow.

This isn’t random, it’s a strategic rotation from ETH to BTC ahead of the Fed decision.

Why this matters for you:

When institutions rotate capital, it often precedes broader market moves. This suggests Bitcoin may outperform Ethereum in the near term, a critical insight for your portfolio allocation.

Corporate Treasury Moves: The Silent Revolution

Corporate adoption of crypto continues to accelerate at an unprecedented pace:

- Sharps Technology (NASDAQ: STSS) acquired over $400 million in Solana (more than 2 million SOL tokens) and formed a strategic partnership with Pudgy Penguins

- Forward Industries (NASDAQ: FORD) invested $1.65 billion to bolster its corporate treasury with Solana

- Helius Medical Technologies (Nasdaq: HMTI) is establishing a $500 million corporate treasury reserve centered on Solana

This isn’t just about speculation, it’s about real companies integrating blockchain into their core business strategy. For the latest web3 news 2025, these moves represent the beginning of a fundamental shift in how corporations view digital assets.

Nasdaq’s Game-Changing Move

In a landmark development, Nasdaq has officially filed with the SEC to allow trading of tokenized US equities. This would enable investors to choose between conventional stock trades and specific blockchain-backed tokens, potentially merging traditional finance with decentralized systems.

Read the full crypto news report

Why this changes everything:

This isn’t just another crypto story, it’s the institutional gateway to mainstream adoption. When Nasdaq embraces tokenization, it validates the entire blockchain ecosystem.

📊 MARKET SENTIMENT AND RISK ANALYSIS

The Options Market Whispering What Everyone Else Is Missing

Options market data reveals important sentiment shifts that most retail investors are ignoring:

- 20% chance that ETH will fall below $3,500 (up from 18% last week)

- 20% chance that BTC will drop under $100,000 (up from 19%)

- 23% chance BTC will reach above $140,000 by year-end (up 2%)

Sean Dawson of Derive.xyz notes that “short-dated ETH volatility has risen from 34% to 51% since Friday.

However, this remains lower than the weekly implied volatility (65%), suggesting that traders expect muted price action around CPI, but more movement on broader macro timeframes.”

Get more crypto news predictions

The key insight: The market is pricing in stability around CPI data but expects bigger moves later. This means the real volatility might come after the immediate catalyst.

Your Risk Checklist: What Could Go Wrong

Despite bullish sentiment, several risks could impact the anticipated rally:

- Whale Distribution: Over 116,000 BTC worth approximately $12.7 billion exited major wallets during the past month, the largest distribution since July 2022

- The Fed Factor: Markets may have already priced in the expected rate cuts, potentially limiting upside

- Solana’s Achilles Heel: Historical network outages remain a concern despite recent improvements

Don’t panic, prepare: For the latest web3 news today, these risk factors represent the key challenges facing the market.

But remember: every bull market has pullbacks. The question isn’t if there will be volatility, but how you’ll position yourself to take advantage of it.

🔍 TECHNICAL ANALYSIS: KEY LEVELS TO WATCH

Bitcoin’s Path Forward: Your Action Plan

The technical setup suggests Bitcoin must maintain above $114,000 on a weekly closing basis to preserve bullish momentum. But here’s your step-by-step action plan:

- If Bitcoin breaks $116,000: Add to positions incrementally up to $120,000

- If Bitcoin drops below $114,000: Wait for retest of $112,500 before adding

- If Bitcoin closes below $112,000: Reassess your strategy, this changes the outlook

A decisive break above $120,000 could accelerate the move toward $160,000 targets based on the MACD golden cross pattern. This technical formation suggests potential for a 40% rally similar to April’s performance.

The Solana Breakout You Can’t Ignore

Solana’s technical position is particularly strong:

- Current Price: $219

- Resistance: $225 (immediate), $240 (strong)

- Support: $210 (critical), $200 (major)

The network’s 100% uptime for nearly 16 consecutive months (as of June 2025) has addressed previous stability concerns, making it more attractive to institutional investors. For the latest solana crypto news, this reliability metric represents a critical factor in its growing institutional adoption.

Pro tip: Watch the $225 level like a hawk. A sustained break above this level could trigger a move toward $240 in short order.

🔮 WHAT’S AHEAD: THE NEXT 30 DAYS

The Fed Decision: Your Playbook

The September 17 Fed decision isn’t just another market event, it’s the most critical catalyst for the remainder of Q3.

Here’s your playbook:

| Fed Outcome | Probability | Market Impact | Your Action |

|---|---|---|---|

| 50 basis point cut | 5% | Massive rally across all crypto | Add positions aggressively |

| 25 basis point cut | 95% | “Calm grind higher” | Dollar-cost average in |

| No cut | <1% | Sharp correction | Protect profits, wait for dip |

The hidden opportunity: Most investors focus only on the rate decision itself. But the real money is made in the days after the announcement, when volatility creates asymmetric opportunities.

Three Institutional Catalysts to Watch

- Potential Solana ETF approval: Predicted for late 2025, could bring billions in institutional capital

- Firedancer validator client implementation: Expected to significantly improve Solana’s network performance

- Alpenglow Consensus Upgrade: Scheduled for early 2026, aiming to cut transaction finality times from over 12 seconds to 150 milliseconds

For the latest web3 news today, these upcoming events represent the most critical catalysts that could drive the next major market move.

But here’s what most miss: The anticipation of these events often creates bigger moves than the events themselves.

💡 STRATEGIC INSIGHTS FOR INVESTORS

The Fed Decision Playbook: Three Strategies for Three Scenarios

With the Federal Reserve decision just days away, here’s how to position your portfolio for all outcomes:

Scenario 1: 50 Basis Point Cut (5% Probability)

- Action: Aggressively add positions in BTC, ETH, and SOL

- Why: This would trigger what derivatives analyst Greg Magadini describes as “a massive +gamma BUY signal for ETH, SOL and BTC”

- Target: Ride momentum toward $160,000 Bitcoin

Scenario 2: 25 Basis Point Cut (95% Probability)

- Action: Dollar-cost average into quality assets

- Why: The market has likely priced this in, so expect a “calm grind higher”

- Target: Focus on assets with strong fundamentals like Solana and Ethereum

Scenario 3: No Cut (Less Than 1% Probability)

- Action: Protect profits, wait for correction

- Why: This would be a major surprise, triggering short-term volatility

- Target: Look for buying opportunities at key support levels

The 5% Rule That Keeps You Profitable

Here’s the uncomfortable truth: Most investors lose money during bull markets because they take too much risk early and get shaken out.

My simple rule: Never risk more than 5% of your portfolio on any single position. This means:

- If you have $10,000, no single position should exceed $500

- This protects you from catastrophic losses while still allowing meaningful gains

- It keeps your emotions in check during volatile periods

The One Chart Every Crypto Investor Should Watch

Forget the price charts for a moment. The single most important indicator right now is the Bitcoin Dominance Index:

- Currently at 51.2% (up from 49.8% two weeks ago)

- Rising dominance = institutional rotation into BTC

- Falling dominance = altcoin season

When dominance breaks above 52%, it often signals a Bitcoin-focused rally. When it drops below 48%, it typically precedes major altcoin moves.

Your action: Watch this indicator daily. It’s the canary in the coal mine for broader market rotation.

📚 FURTHER READING

- Why Bitcoin Is Surging Today: Technical Analysis and BTC Price Predictions – Essential reading for understanding the MACD golden cross pattern and its implications

- Solana Surges Past Ethereum in DEX Volume – Comprehensive analysis of Solana’s growing dominance

- What’s Next for Bitcoin and Ether Ahead of Fed Rate Cut – Expert insights on the upcoming Fed decision’s impact

- Why Crypto is Up Today: September 9 Market Analysis – Detailed breakdown of institutional flows and market sentiment

🎯 FINAL THOUGHTS: Your Roadmap to Q4 Success

Let’s cut through the hype. The convergence of technical breakout patterns, institutional accumulation, and favorable macroeconomic conditions creates a compelling bullish case for cryptocurrencies through the remainder of 2025.

Here’s what most people miss: This isn’t just another cycle. We’re witnessing the transition from speculative mania to sustainable growth driven by real-world utility and institutional participation.

Your action plan:

- Maintain a core Bitcoin position (5-10% of portfolio)

- Add selective altcoin exposure (Solana, Ethereum) while maintaining 60-70% in BTC

- Set alerts at key technical levels ($114,000, $116,000, $120,000 for BTC)

- Never risk more than 5% on any single position

- Watch the Bitcoin Dominance Index for rotation signals

The coming weeks will be pivotal. Whether the Fed delivers a 25 or 50 basis point cut could determine whether we see a “calm grind higher” or a “massive buy signal” accelerating the move toward $160,000 Bitcoin.

Final thought: This isn’t just about making money, it’s about positioning yourself at the forefront of the financial revolution. For the latest web3 news and crypto news today, this period represents a critical inflection point in the maturation of the digital asset market.

P.S. Want to know which altcoins are quietly building massive institutional followings before the next bull run?

Hit reply and let me know,I’ll share my top three hidden gems that could 10x before year-end.

(This information isn’t in the public newsletter, only for engaged readers like you.)

Leave a comment