Let’s rewind to 2023.

PulseChain, a promising Ethereum fork, launched with big dreams:

- Faster transactions

- Lower fees

- A vibrant ecosystem

But by late 2024, it was on life support.

- Fees (24h): Just $48,370

- Price: $0.00003582 (down 89% from its 2023 peak)

- Volume (24h): A measly $18K

Critics called it a “ghost chain.”

Developers avoided it

Then, in early 2025, everything changed.

A meme-powered app called pump.tires lit the fuse.

Here’s how it happened — and how you can copy this playbook to revive your own blockchain.

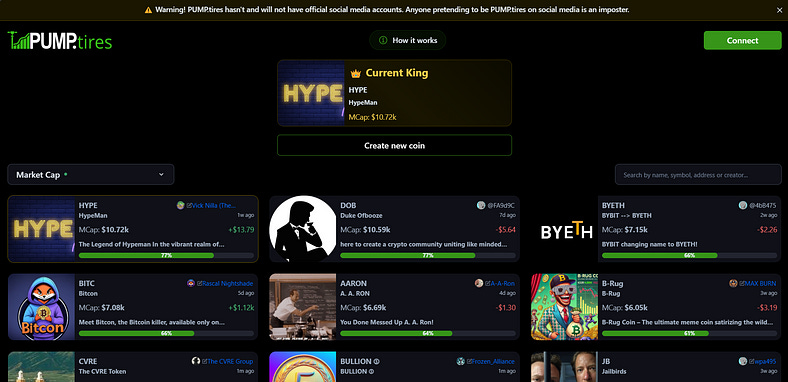

The Pump.tires Effect on Pulsechain.com

Pump.tires — a clone of Solana’s viral Pump.fun platform — launched on PulseChain.

Suddenly, users could create and trade meme coins in seconds.

Here’s how it revived the chain:

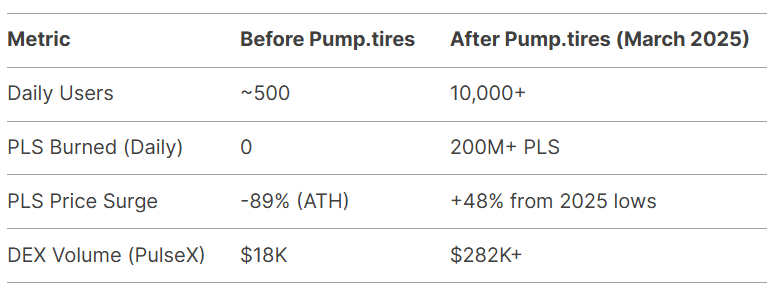

1. The Buy-and-Burn Engine

Every meme coin transaction on Pump.tires burns 1% of the chain’s native token, PLS.

This simple rule did two things:

- Reduced Supply: Over 200 million PLS were burned in March 2025 alone, creating scarcity.

- Price Stability: PLS surged 48% from its 2025 low, with a market cap hitting $505 million.

2. Liquidity Explosion

New meme coins like $PUMP funneled liquidity back into PulseChain’s ecosystem:

- PulseX (PulseChain’s DEX) saw daily volume jump from 18K to 282K.

- The PUMP/WPLS liquidity pool grew to $8.5M, attracting traders from Solana and Base.

3. Viral Community Growth

PulseChain’s social channels exploded:

- Discord members tripled.

- Developers began building apps like fiat on-ramps and prepaid crypto cards to support new users.

Suddenly, PulseChain wasn’t a ghost town anymore.

Why Meme Coins Are the Ultimate Lifeline?

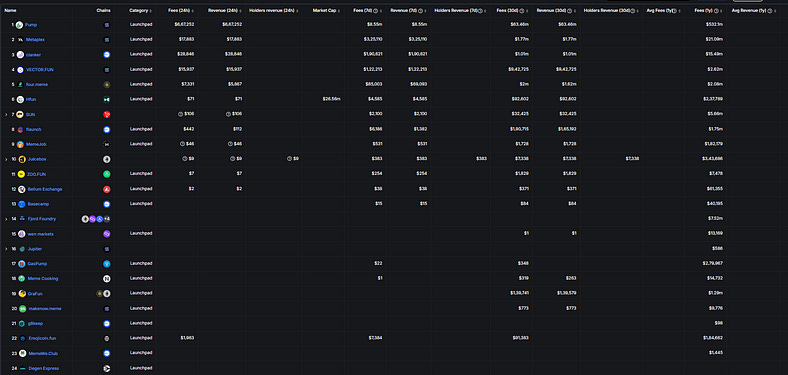

PulseChain.com isn’t unique.

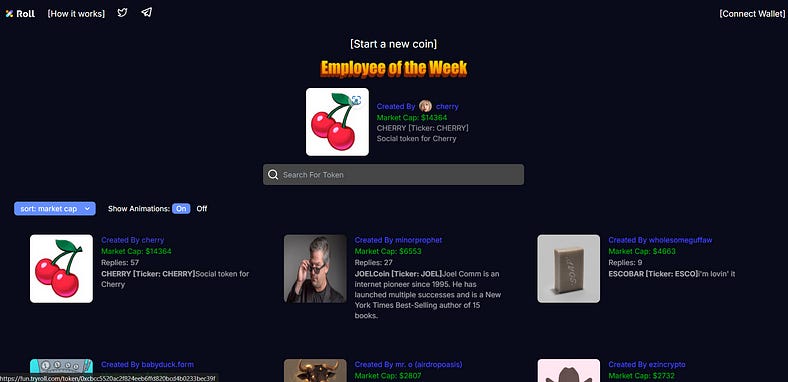

Chains like Solana and Base have ridden meme frenzies to success. here are few launchpads:

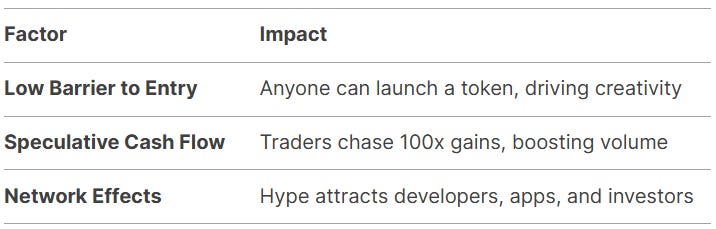

Here’s why this strategy works:

But there’s a catch: “meme coins are volatile.”

Pump.tires faced accusations of being a “scammer’s playground.”

Yet, PulseChain’s team leaned into the chaos, using the influx to fund long-term tools like stablecoin bridges and governance upgrades.

The Dark Days Before the Meme Wave

Before Pump.tires, PulseChain’s problems ran deep:

- Stagnant Development: Only 12 dApps were live by late 2024.

- Token Confusion: Users struggled to differentiate PLS, PLSX, and other ecosystem tokens.

- Regulatory Fear: The SEC’s lawsuit against founder Richard Heart scared away institutional players.

Pump.tires didn’t fix these issues overnight.

But it bought PulseChain time — and attention — to rebuild.

How Your Chain Can Replicate This Success

If your Ethereum Layer 2 (EVM chain) or non-EVM Chain is struggling, here’s a roadmap:

1. Deploy a Meme Coin Factory

Use a pre-built solution like Pump.fun clone to launch quickly.

Key features:

- Token creation in <60 seconds.

- Built-in buy-and-burn mechanics for your native token.

- Liquidity auto-staking into your DEX.

2. Fuel the Hype Cycle

- Partner with influencers to host meme contests.

- Airdrop rewards to early adopters.

- Share success stories (e.g., “This trader turned 100 into 50K”).

3. Convert Hype into Infrastructure

PulseChain used meme-driven fees to fund:

- PulseX V2: A faster DEX with concentrated liquidity.

- StableSwap: Low-slippage stablecoin trading.

The Risks (And How to Mitigate Them)

Meme coins are risky, but smart chains plan for it:

- Rug Pulls: Audit meme projects or flag unaudited tokens.

- Volatility: Use a portion of fees to stabilize your native token’s price.

- Reputation Damage: Balance memes with “serious” projects (DeFi, NFTs, RWA).

PulseChain’s revival wasn’t just luck — it was strategy.

The Future of PulseChain (And Lessons for You)

Today, PulseChain is a case study in community-driven revival.

Analysts compare its trajectory to Solana’s 2023 rebound, fueled by BONK and Dogwifhat.

Your move?

- Test a meme platform risk-free: Roll Protocol’s Live Demo.

- Customize the codebase for your chain’s needs.

- Need help with customization, connect with me.

LinkedIn | Telegram | Website

Meme coins aren’t the endgame — they’re the spark.

PulseChain lit the match.

Now it’s your turn.

Leave a comment