Zeebu didn’t rise by chasing crypto trends.

Instead, it fixed a broken system— “telecom payments” and turned it into a $958 million market cap powerhouse.

Here’s how they did it, and what others can learn.

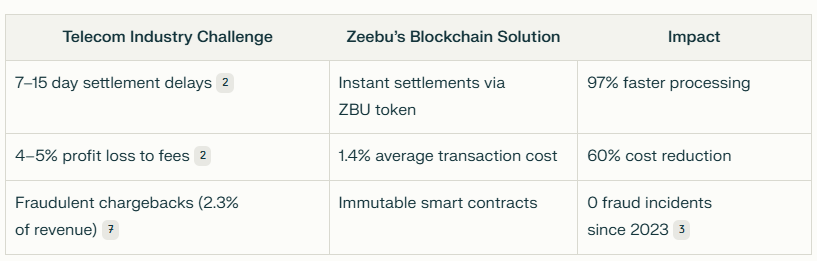

The Problem: Telecom’s $120B Payment Crisis

Telecom companies faced systemic inefficiencies:

- 7–15 day settlement delays eating into cash flow

- 4–5% profit loss to middlemen fees and FX costs

- 2.3% revenue leakage from fraud and chargebacks

Zeebu’s blockchain solution slashed these pain points:

- Instant settlements (3–7 minutes vs. weeks)

- 1.4% average transaction cost (60% savings)

- Zero fraud incidents since 2023 via immutable smart contracts

Zeebu’s Rise: A 3-Phase Blueprint

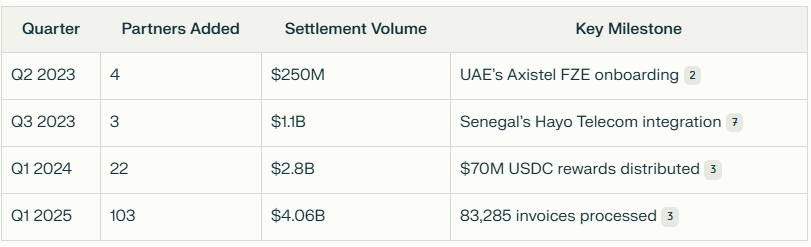

Phase 1: Niche Domination (2023–2024)

Early Traction

- Landed 7 telecom partners in Q3 2023, including Broadband Telecom Inc. ($1.2B revenue)

- Processed $1.5B in settlements by Q1 2024

- Burned 6.4% of ZBU supply (321M tokens) to counter inflation

Phase 2: Institutional Adoption (2024–2025)

Partnership Growth

- 103 telecom clients by Q1 2025, including UAE’s Axistel FZE and Senegal’s Hayo Telecom

- $4.06B in settlements and 83,285 invoices processed

Enterprise Incentives

- Distributed 42.3M ZBU loyalty rewards ($61M value)

- Generated $63.52M in fees via a 2% transaction model (1.4% to users, 0.6% protocol fee)

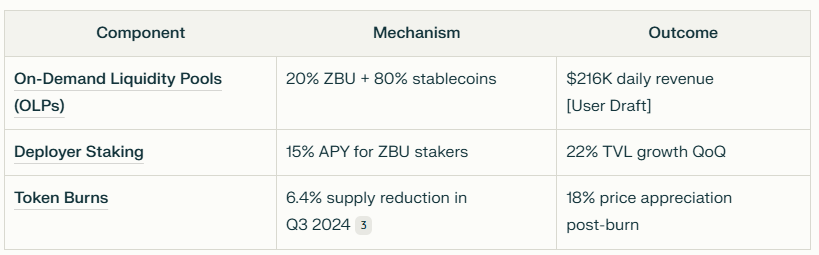

Phase 3: Protocol Innovation (2025)

Liquidity Architecture

- On-Demand Liquidity Pools (OLPs): 20% ZBU + 80% stablecoins, generating $216K daily revenue

- 15% APY for stakers, driving 22% quarterly TVL growth

Security

- 3 independent audits by Hacken (zero critical flaws)

- 7-minute KYC onboarding with blockchain-verified credentials

5 Replicable Strategies for Web3 Success from Zeebu

1. Niche Domination Playbook

- Step 1: Target industries with >5% operational waste (e.g., healthcare, logistics).

- Step 2: Pilot with 3–5 anchor clients to refine your MVP.

- Step 3: Allocate 15–20% of token supply to usage rewards (e.g., Zeebu’s 42.3M ZBU loyalty pool).

2. Hybrid Tokenomics

- Utility: Link tokens to fees, staking, and governance.

- Deflation: Burn 1–3% of supply per $1M revenue (Zeebu burned 6.4% in Q3 2024).

- Stablecoin Rewards: Convert fees to USDC or USDT to avoid inflationary token models.

3. Partnership Acquisition Funnel

- Lead Generation: Pitch at industry events (e.g., ITW 2023).

- ROI Case Studies: Highlight savings like “$12M/year for Broadband Telecom.”

- Frictionless Onboarding: Aim for <10-minute KYC.

- Tiered Rewards: Offer fee discounts for high-volume partners.

4. Security First

- Conduct 3+ independent audits pre-launch.

- Prioritize compliance tools (e.g., paperless AML checks).

5. Community-Driven Growth

- Reward early adopters with tokens tied to activity, not sign-ups.

- Use ambassador programs and airdrops (Zeebu distributed 60M ZBU).

Lessons from Zeebu’s Leadership

- Raj Brahmbhatt (CEO): “We courted telecom CFOs, not crypto VCs.”

- Keshav Pandya (COO): “Build compliance tools before marketing.”

Decision Framework

- Allocate 30% of budget to security audits.

- Prioritize enterprise UX over DeFi trends.

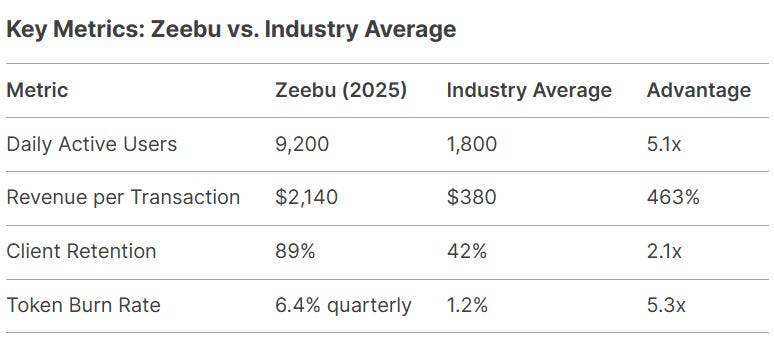

Final Takeaway

Zeebu’s $5.6B in transactions and 135+ clients prove that solving real-world problems beats speculative hype.

- Measurable ROI (e.g., 60% cost reduction).

- Deflationary tokenomics tied to usage.

- Institutional-grade UX.

The next Zeebu won’t emerge from crypto Twitter—it’ll come from fixing broken financial systems.

Leave a comment